We are pleased to share news of a new book relevant to…

Top 500 list shows growth for mutual insurers

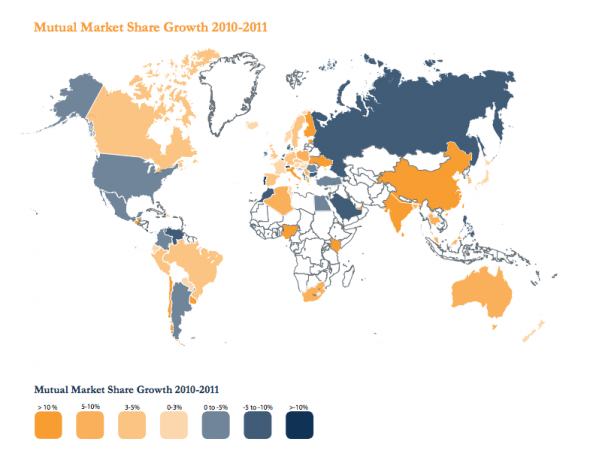

A new report shows nearly a fifth of the world’s top mutual and co-operative insurers experienced double-digit premium growth in 2011, with 33 companies growing by over 20 per cent.

The International Cooperative and Mutual Insurance Federation Global 500, published by the International Co-operative Alliance's sectoral organisation ICMIF, lists the 500 largest mutual and co-operative insurers, based on premium income from 3,300 companies in 77 markets worldwide.

In 2011, the Global 500 collectively wrote USD1,189 billion in premiums, representing 98 per cent of the global mutual market.

Total premiums for the top 500 increased by 3.1 per cent from 2010, and 348 companies, 70 per cent of the list, posted positive growth, seven more than in 2010.

Mutuals from North America and Europe dominated the list, comprising 85 per cent. The USA was best represented, with 207 mutuals making the top 500. Germany had 38, France 32 and Spain 25, with 21 companies from Denmark, many of which were pension mutuals, and 10 from Finland. There were 19 British mutuals on the list.

Other nations with a strong presence included Japan, with 24 companies, and Australia, with 19. There were record numbers from developing markets, with 11 from Latin America, compared to eight in 2010, and four from Africa, compared to three in 2010.

The top 20 represented 54 per cent of the total premium income of the 500 companies. Of these, nine were from the USA, four from Japan and seven from Europe.

ICMIF member Zenkyoren remained number one, with premiums of USD 81,687 million, up five per cent from 2010. Meiji Yasuda, with premiums USD 49,935 million, up 20 per cent on the previous year, placed fourth.

The fastest growing insurance mutual was USA firm Employees Life Co, which increased its premiums by 1,372 per cent in four years, from USD 25,421 in 2007 to USD 374,147 in 2011.

Other star performers between 2007 and 2011 included the PURE Group of Insurance Companies, also from the USA, and Prudential BSN Takaful of Malaysia, which posted 562.2 and 526.9 per cent growth respectively.

The global insurance industry suffered in 2011, due to the financial crisis and high incidence of natural and man-made disasters. It was the second-highest catastrophe loss year ever, with USD 116 billion in insured losses and record economic losses of USD 370 billion. Global premiums declined in real terms for the third time in four years.

However, the report says, mutual and co-operative insurers have consistently out-performed other insurance companies since the global financial crisis began. ICMIF research shows that between 2007 and 2011 premium income for the sector grew by 26 per cent and its global market share grew from 24 to 27 per cent.

Report author Ben Telfer said consumers’ buying behaviours had changed: “Against the backdrop of recession, customers typically become more cost-conscious, and seek insurance at lower cost, as is traditionally associated with mutual and co-operative insurers,” he said.

“It could also been argued that there’s been a consumer reaction against the ‘greed culture’ propagated by jointstock banks and insurers, and diminishing trust, particularly among customers seeking a ‘safe’ place to invest their life insurance premiums. Mutual and co-operative insurers, free of the need to provide returns to shareholders and thus able to pursue strategies which protect the long-term interests of their respective businesses and customers, offer consumers a competitive and attractive alternative.”

• The report is only available for members of ICMIF. For more details, visit: http://www.icmif.org/2011-mutual-market-share-icmif-global-500-reports