European co-operative banks in 2018

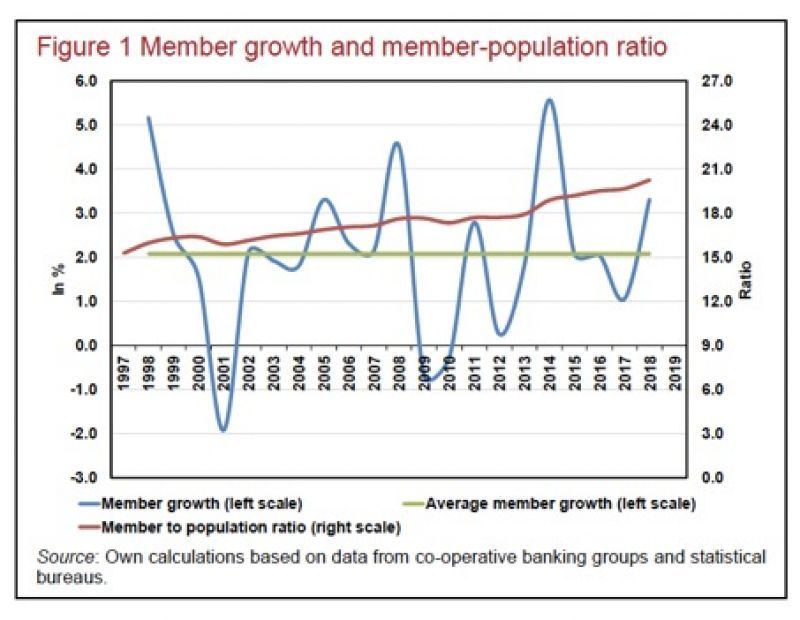

This research letter written by Professor Hans Groeneveld, Tilburg University, the Netherland presents consolidated financial indicators of 18 co-operative banking groups in 13 European countries for 2018.2 It is intended for cooperative bankers, policy-makers, regulators and academics. Collectively, the number of members increased sharply by 3.3 percent to almost 85 million. The market shares in domestic retail banking went up by about 0.5 percentage point and reached their highest levels ever. The comparison between key financial metrics of co-operative banking groups and the entire banking sector shows a mixed picture. The average Tier 1 ratio of co-operative banks rose to a record high of 15.9, whereas this ratio declined somewhat to 15.3 for all other banks. The average return on equity did not change compared to 2017 (6.8%). The average cost-to-income ratio of both categories of banks rose by around 1.5 percentage point, partly due to a decline in the net interest margin. As in many preceding years, co-operative banks provided more new loans to the real economy, reported a higher deposit growth, and reduced their branch network and employment to a lesser extent.